Summary -

In this topic, we described about the Internal Order Settlement and Internal Order Settlement to Cost Centers process along with technical information.

An internal order is used as an interim collector of costs and an assistance to the planning, monitoring and controlling processes needed. The costs can be settle to one or more receivers like cost center, fixed asset, profitability segment, etc, when the job has been completed.

The settlement rule must be saved in each of the senders to settle an order. The settlement rule determines where the costs are to be settled to. The same can be achieved in two ways –

- Settlement to one receiver.

- Compressive settlement.

Internal Order Settlement to Cost Centers: -

As a first step, the settlement rule needs to be created.

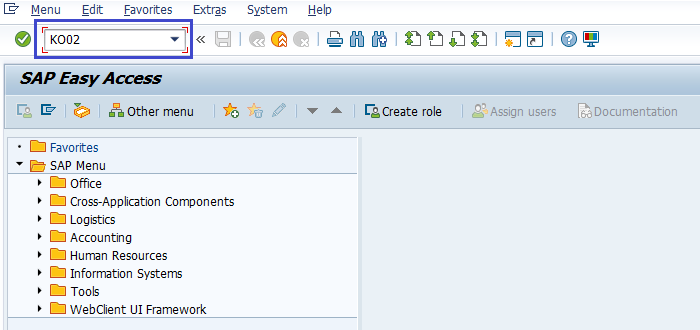

Step-1: Go to transaction KO02.

(OR)

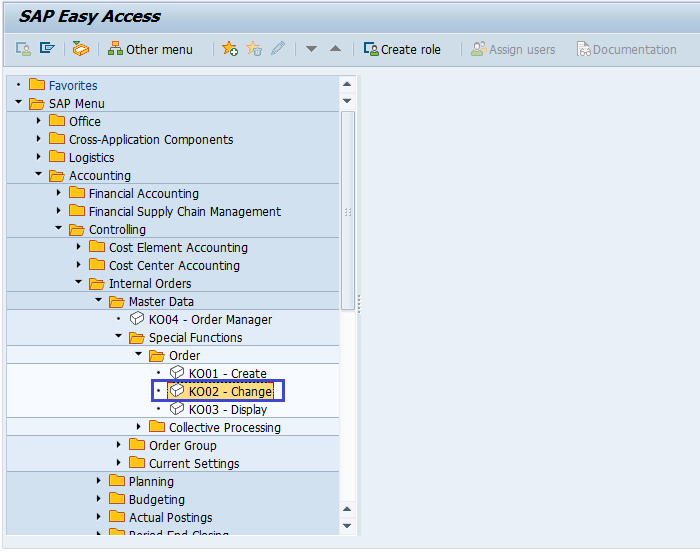

Go to Accounting → Controlling → Internal Orders → Master Data → Special Functions → Order → Change.

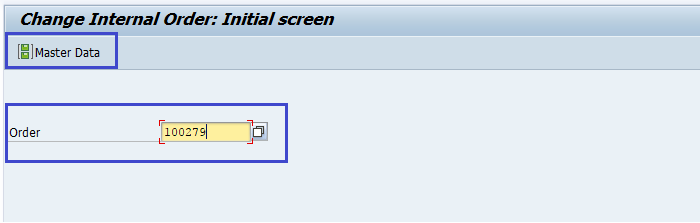

Step-2: In the next screen, enter the order details which requires settlement and click on Master Data to proceed.

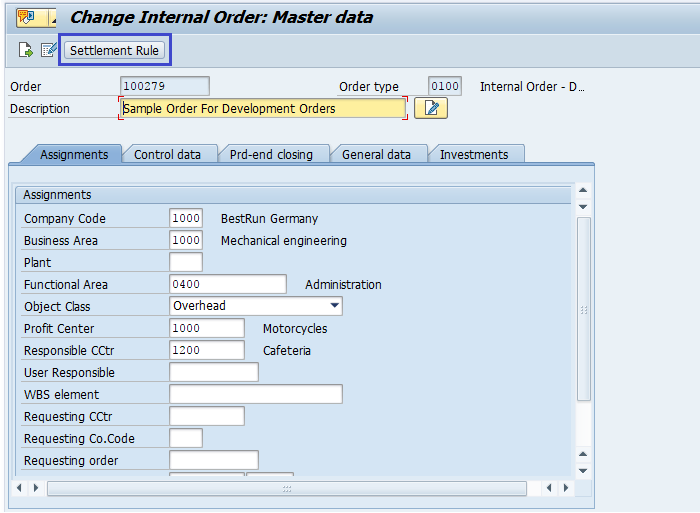

Step-3: Click on the Settlement Rule to proceed.

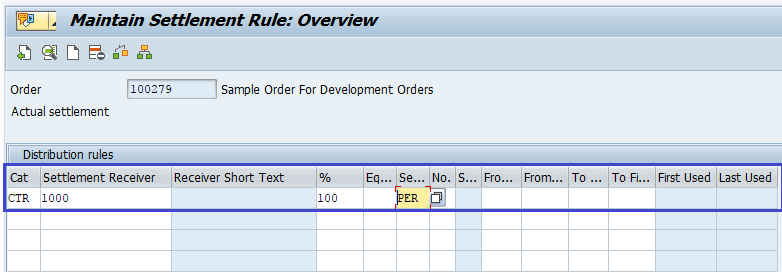

Step-4: Select the Category Column as 'CTR' for cost center from list, Cost center in Settlement receiver Column, enter percentage amount and select Settlement type.

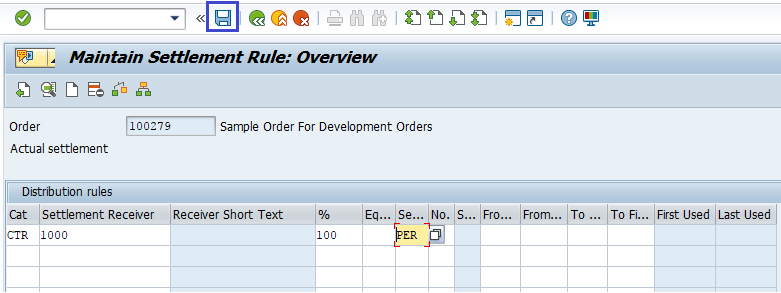

Step-5: Click on the Save button to save the settlement rule.

Once the changes saved successfully, go back to the home screen to settle the order.

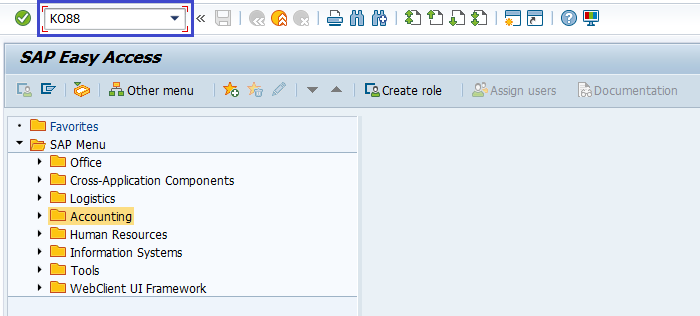

Step-6: To complete the process, go to transaction KO88.

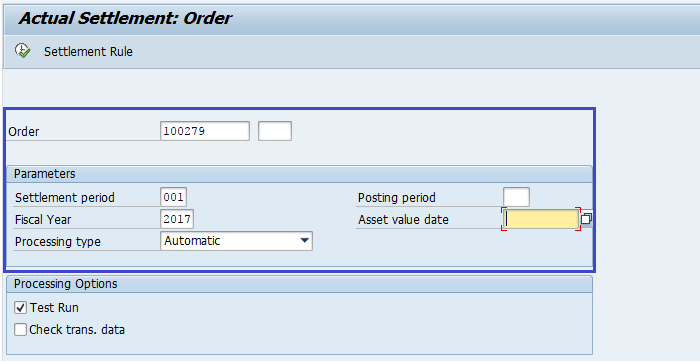

Step-7: Enter the Order, Period for settlement, Fiscal Year and Uncheck the Test Run. Click on Execute button.

New window will open with Settlement display message and click the Continue button to complete the settlement process.

Technical details: -

- Transaction: KO02

- Menu Path: Accounting → Controlling → Internal Orders → Master Data → Special Functions → Order → Change