Summary -

In this topic, we described about the below sections -

Below process shows how to generate withholding tax while payment posting.

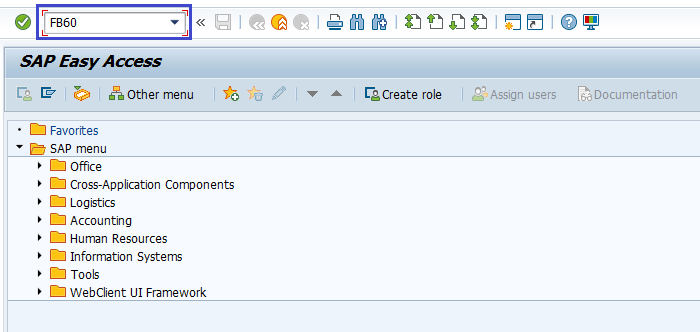

Step-1: Enter the transaction code FB60 in the SAP command field and click Enter to continue.

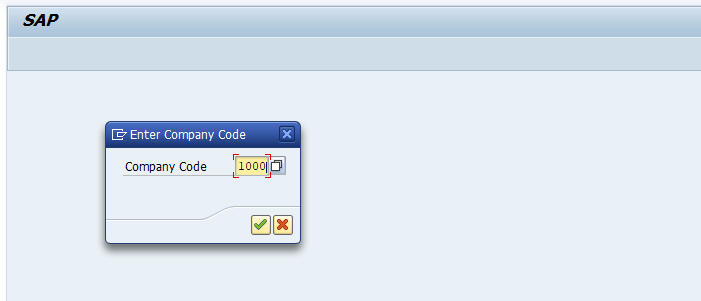

Step-2: In the next screen, enter the Company Code and press Enter.

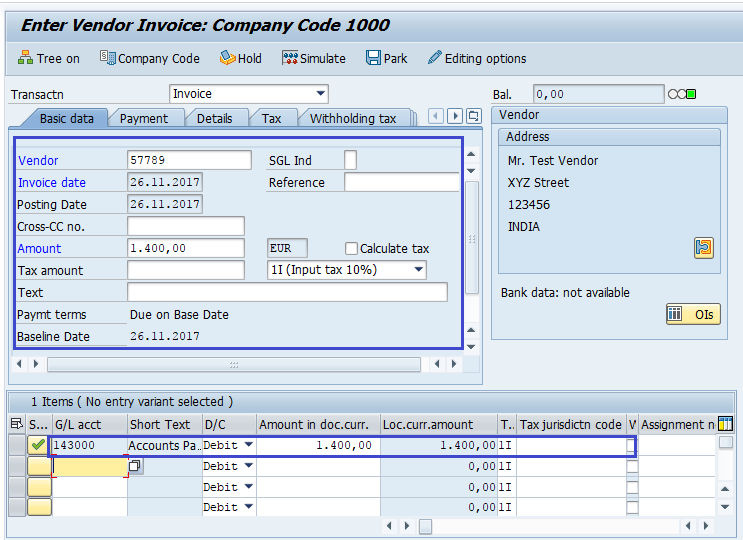

Step-3: In the next screen, enter the below details in the Basic Data tab.

- Vendor ID of the Vendor to be Invoiced

- Invoice Date

- Check Document Type Vendor Invoice

- Amount for Invoice

- Select Tax Code for the Tax Applicable

- Select Tax Indicator "Calculate Tax"

- Purchase Account

- Amount for the Invoice

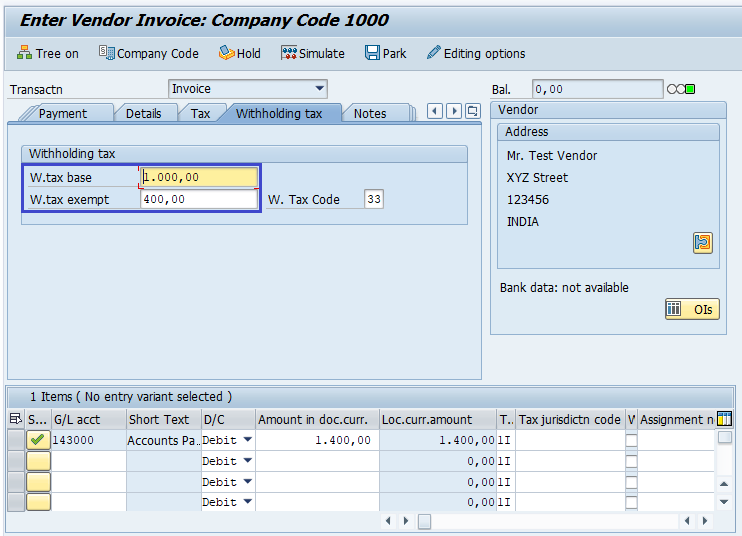

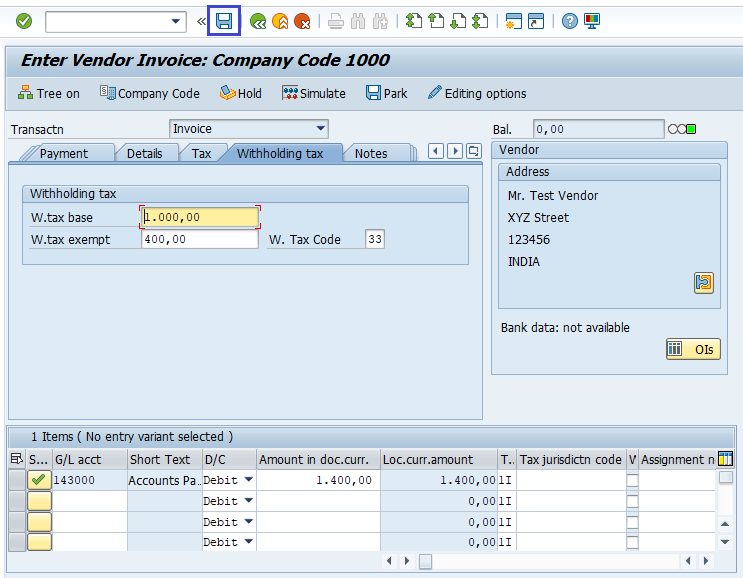

Step-4: Enter the below details in the Withholding Tax tab.

- Tax Base Amount

- Tax Exempt Amount

- Check the Withholding Tax Code

Step-5: Once all the details entered, click on the Save button to save the changes.

Status bar displays the generated document number once the payment posting completed successfully.

Technical Information: -

- Transaction Code: - FB60

- Navigation path: - n/a