Summary -

In this topic, we described about the Check Calculation Procedure process along with technical information.

By default, SAP system configuration comes up with predefined tax calculation procedures for all most all countries. In some cases, it is required to define a new tax procedure or modify some existing tax procedure.

In this chapter, we will discuss about creating new tax procedure.

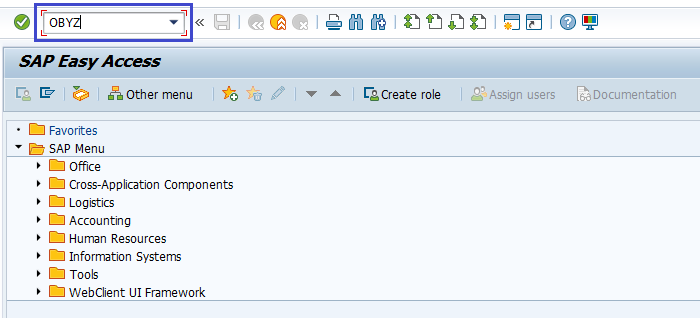

Step-1: Enter the transaction code OBYZ in the SAP command field and click Enter to continue.

(OR)

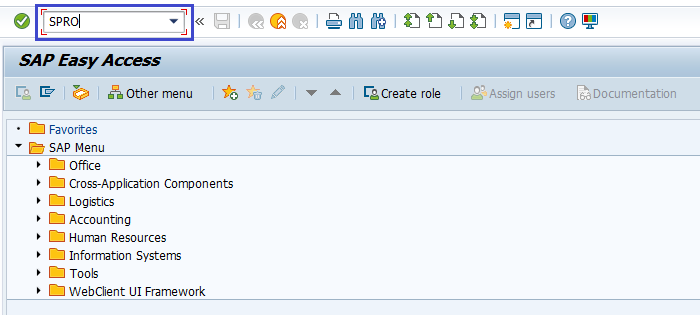

Enter the transaction code SPRO in the SAP command field and click Enter to continue.

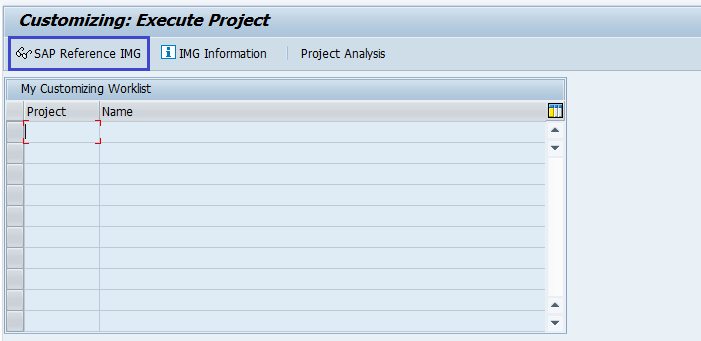

Click on SAP Reference IMG.

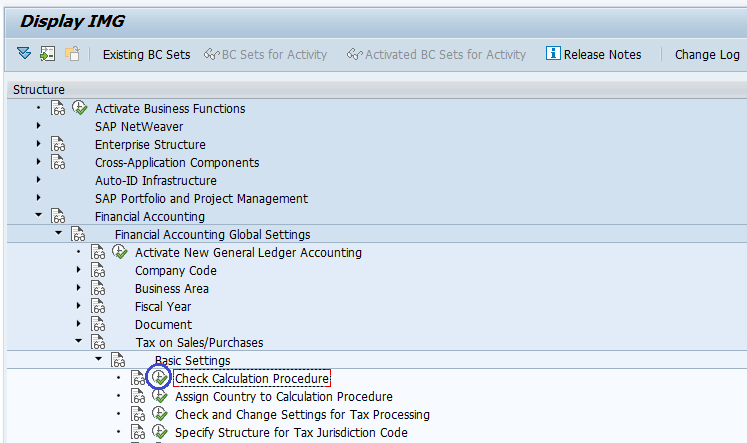

Expand SAP Customizing Implementation Guide → Financial Accounting (New) → Financial Accounting Global Settings (New) → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure . Click on Execute.

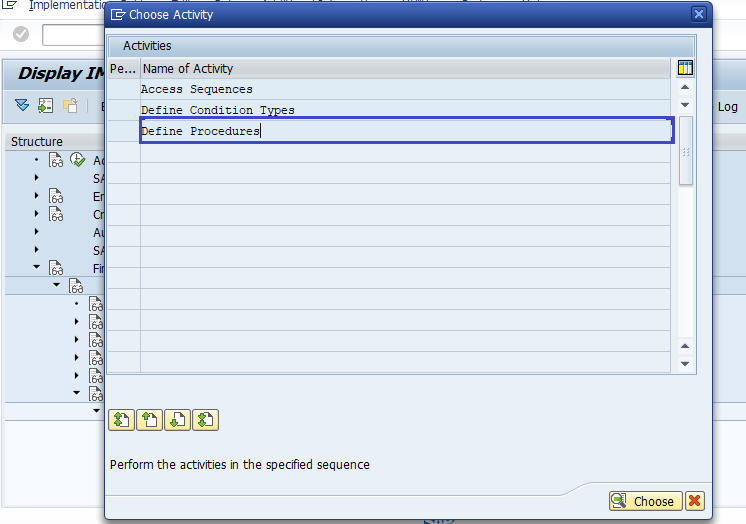

Step-2: A dialog open with the below options. Select Define Procedures and click on choose button.

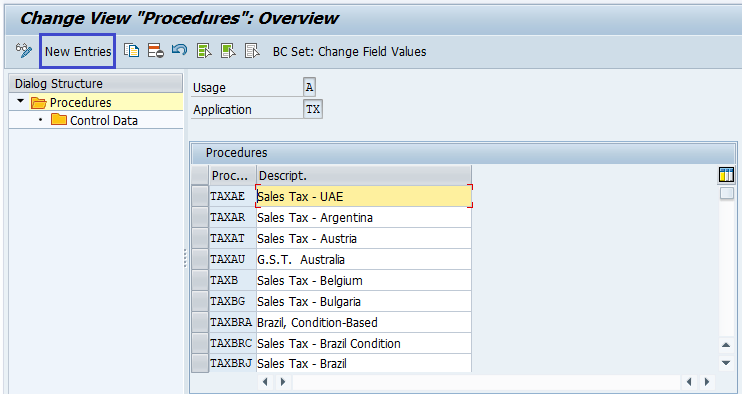

Step-3: In the next screen, select activity New Entries on the application bar.

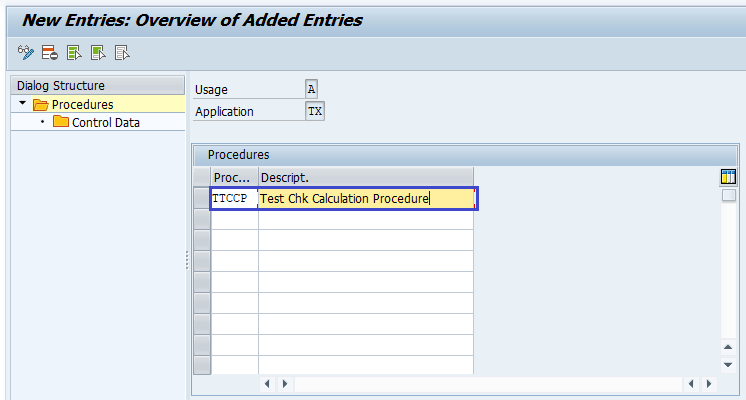

Step-4: In the next screen, enter the below details.

- Procedure – Specify unique check calculation procedure name (6-digit alphanumeric).

- Descript. – Specify the description of check calculation procedure.

Once all the details entered, click on Save button and select the change request to completely saved.

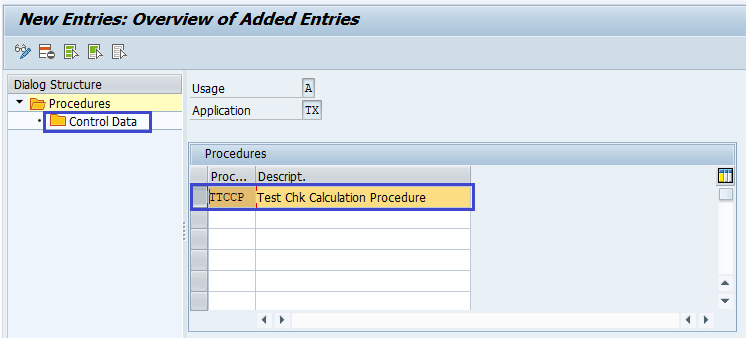

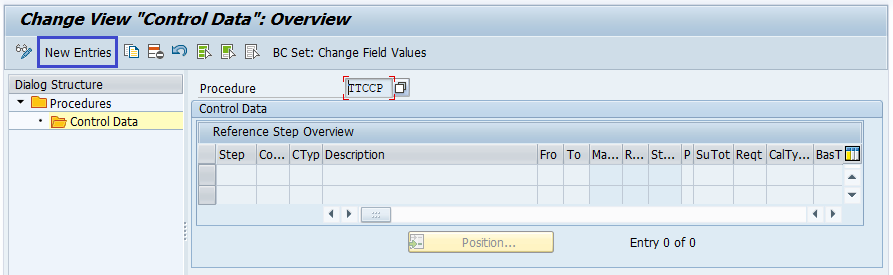

Step-5: In the same screen, select the procedure line entry and double click on Control data.

Step-6: In the same screen, select activity New Entries on the application bar.

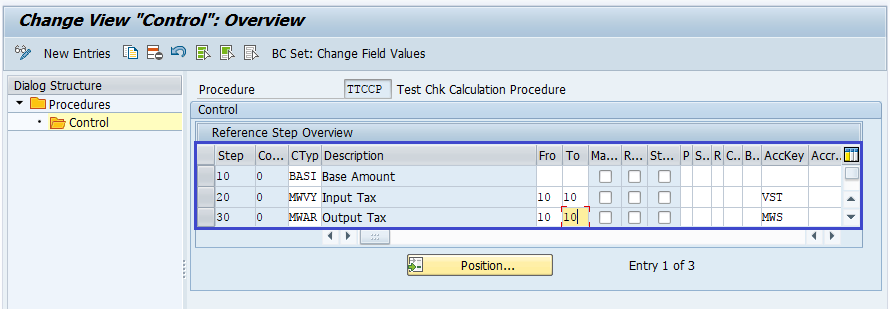

Step-7: In the next screen, enter the below details.

- Step – Specify the step number.

- Counter – Specify the condition type key which indicates each activity or tax.

- CTYp – Select the condition type from the list.

- Fro, To – Specifies the on what percentage of base amount the tax calculated.

- Account Key – Assigns the account for the respective types.

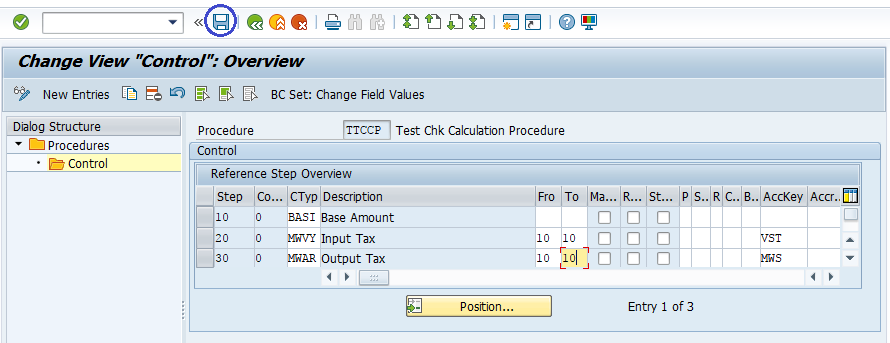

Step-8: Once all the details entered, click on the Save button to save the changes.

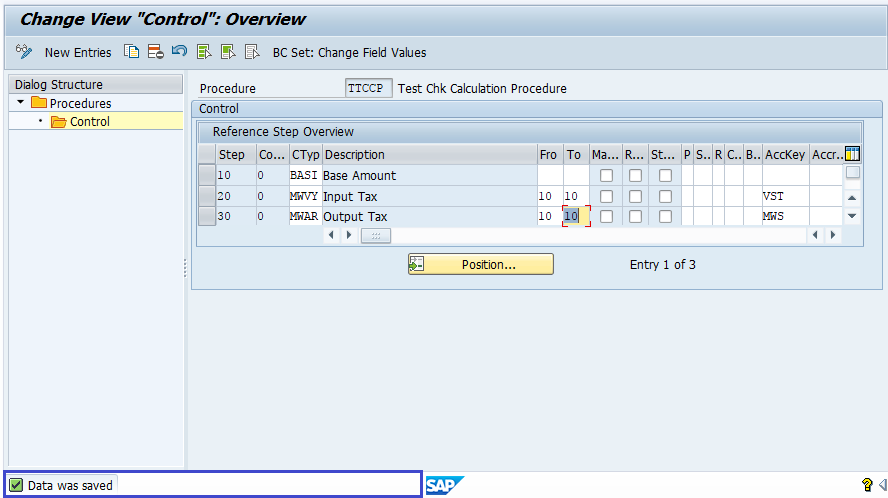

Step-9: Status bar displays the below message once the check calculation procedure defined successfully.

Technical Information: -

- Transaction Code: - OBYZ

- Navigation path: - SPRO → SAP Reference IMG → SAP Customizing Implementation Guide → Financial Accounting (New) → Financial Accounting Global Settings (New) → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure

- Database Table: - T682Z, T682I, T682, T683, T683S, T685A