Summary -

In this topic, we described about the Post Sales Invoice process along with technical information.

Posting accounting data for customers in Accounts Receivable. When posting data in Accounts Receivable, the system creates a document and passes the data entered to the general ledger. General ledger accounts are then updated according to the transaction.

Process: -

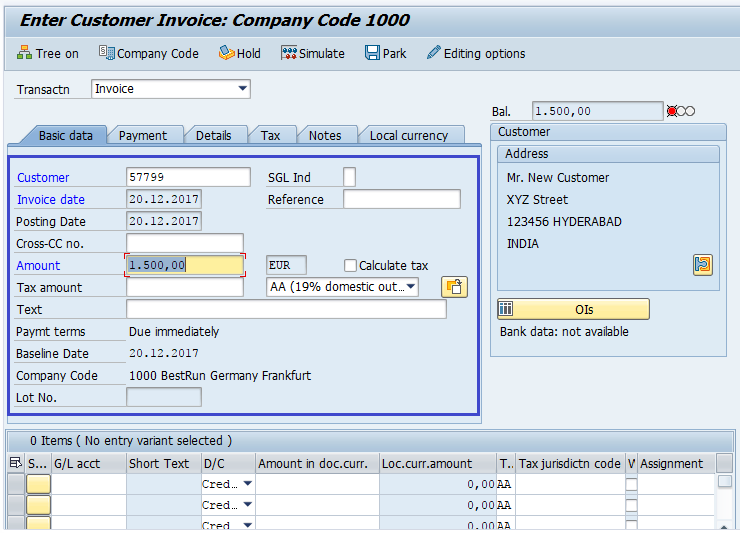

Below process is to post a sales invoice for the customer 57799.

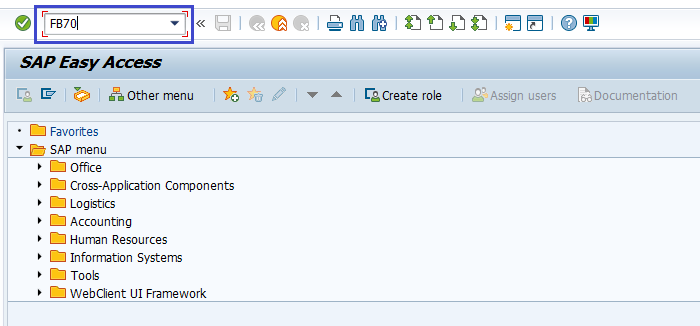

Step-1: Enter the transaction code FB70 in the SAP command field and click Enter to continue.

(OR)

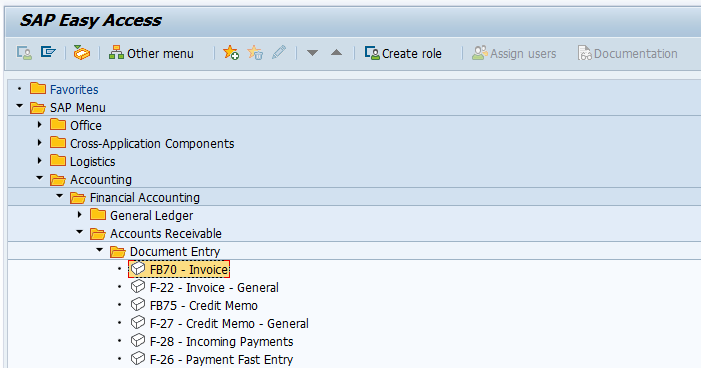

From SAP easy access menu, go to Accounting → Finance Accounting → Accounts Receivable → Document Entry → FB70 – Invoice .

Step-2: In the next screen, enter company code and click on tick mark.

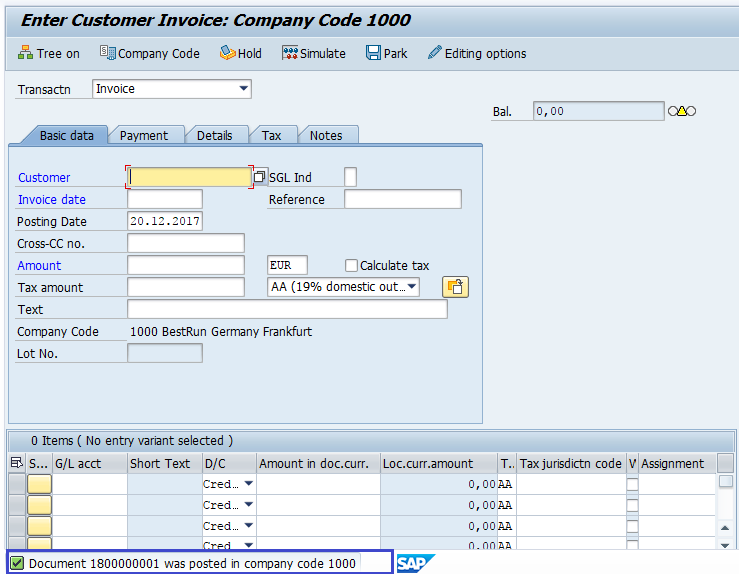

Step-3: In the next screen, enter the below details in the Basic Data tab.

- Customer ID of the customer to be Invoiced.

- Invoice Date.

- Amount for Invoice.

- Tax Code for the Tax Applicable.

- Tax Indicator Calculate Tax.

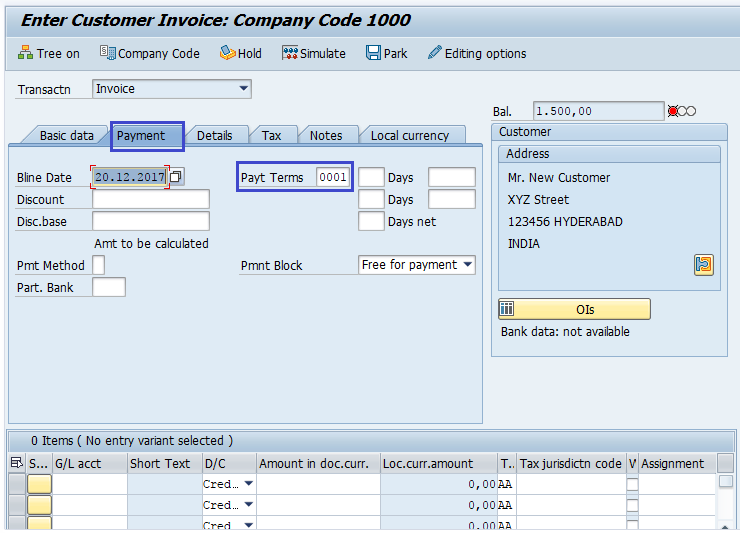

Step-4: Check for payment terms in payment tab.

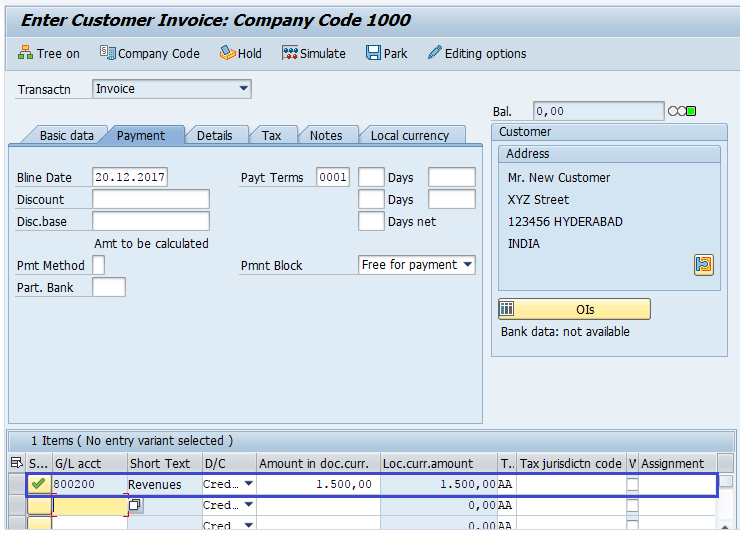

Step-5: In the Item Details Section, enter the below details.

- Sales Revenue Account.

- Credit.

- Amount for the Invoice.

- Check Tax code.

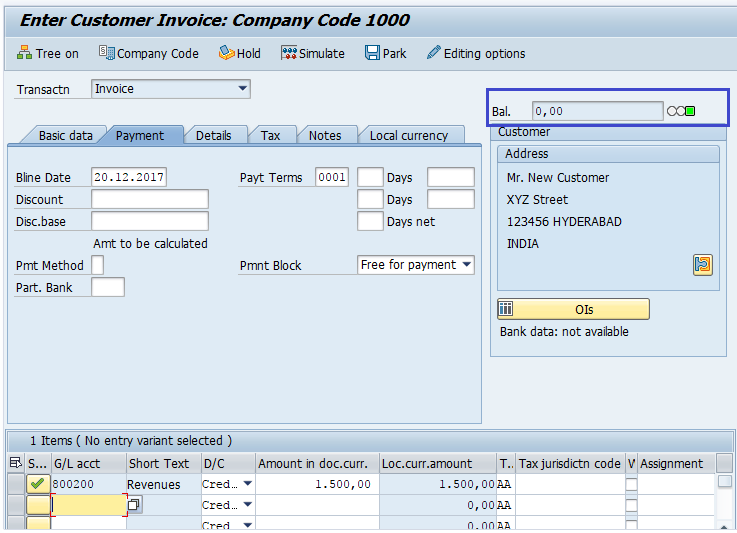

Step-6: After completing the above entries check the status of the document.

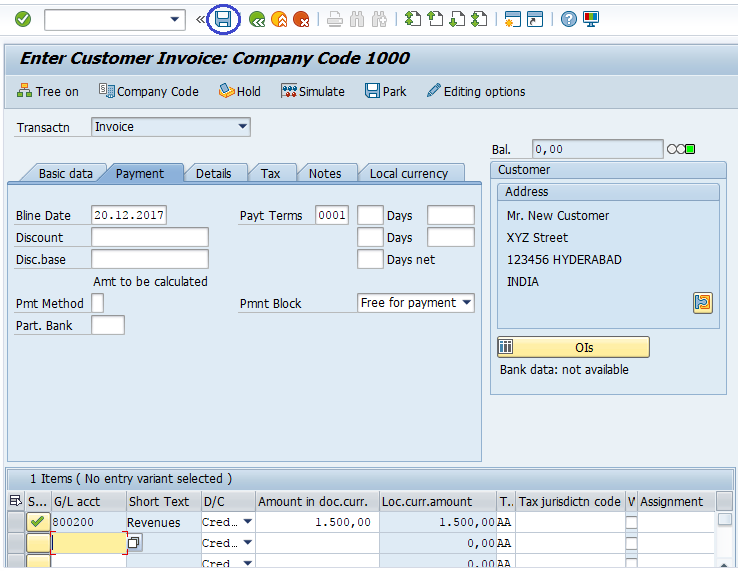

Step-7: Once all the details entered, click on the Save button to save the changes.

Step-8: Status bar displays the generated document number like below once the sales invoice posted successfully.

Technical Information: -

- Transaction Code: - FB70

- Navigation path: - From SAP easy access menu, go to Accounting → Finance Accounting → Accounts Receivable → Document Entry → FB70 – Invoice .