Summary -

In this topic, we described about the Withholding Tax During Payment Posting process along with technical information.

Below process shows Generation withholding tax while vendor invoice posting.

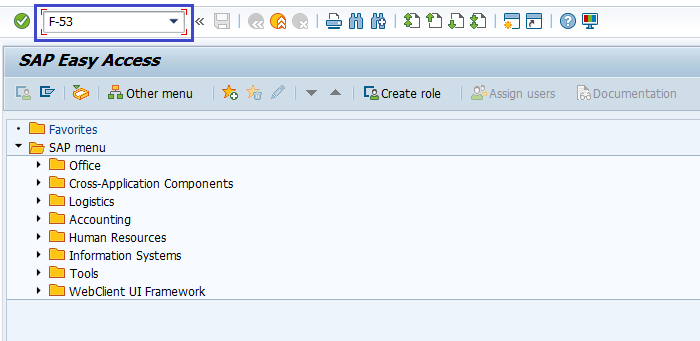

Step-1: Enter the transaction code F-53 in the SAP command field and click Enter to continue.

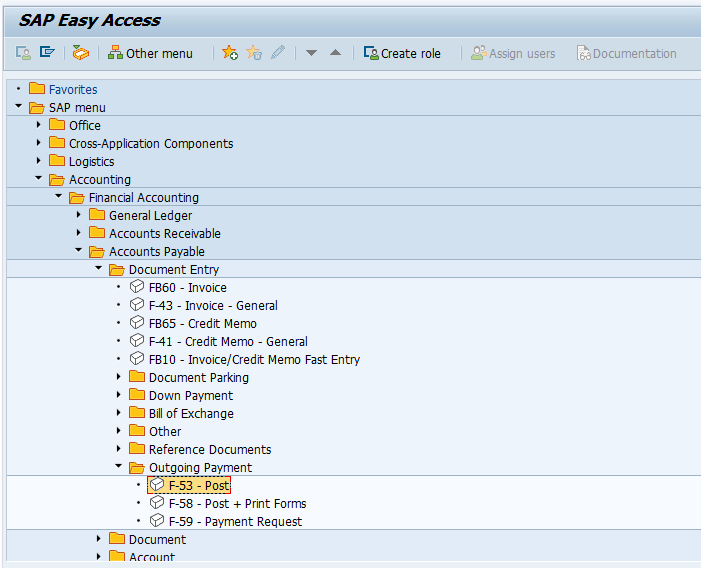

(OR)

Go to SAP Menu → Accounting → Financial Accounting → Account Payable → Document Entry → Outgoing Payment → Post.

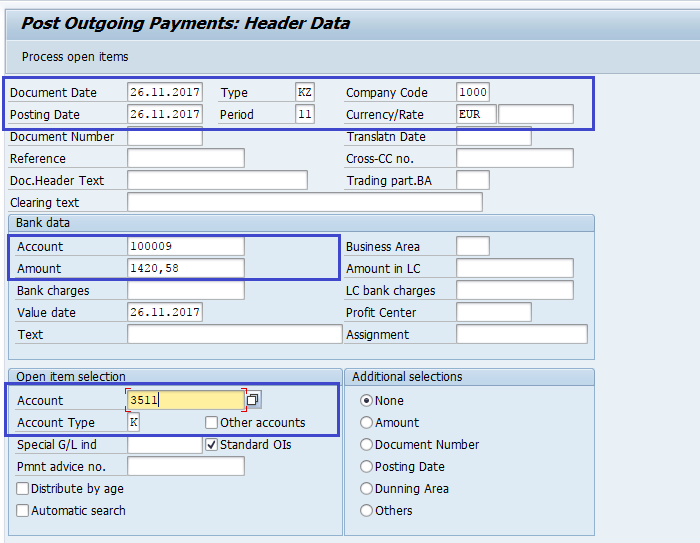

Step-2: In the next screen, enter the below details.

- Document Date.

- Cash/Bank Account the Payment is to be posted.

- Payment Amount.

- Vendor Id of the Vendor receiving the Payment.

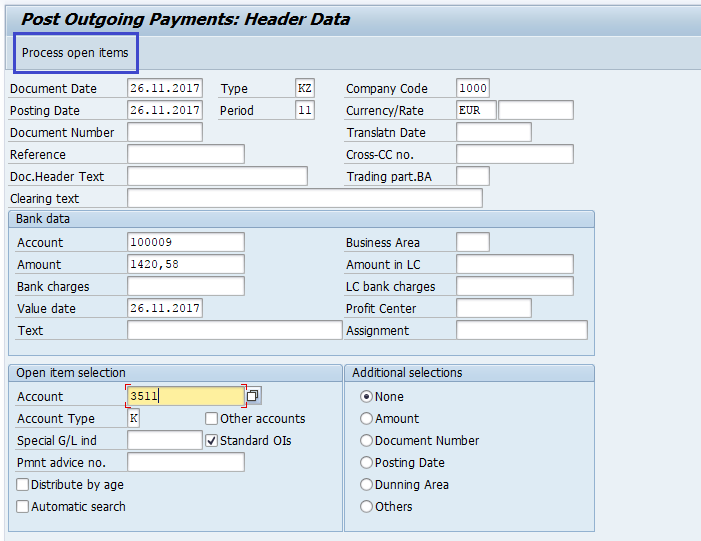

Step-3: In the same screen, click on Process Open Items.

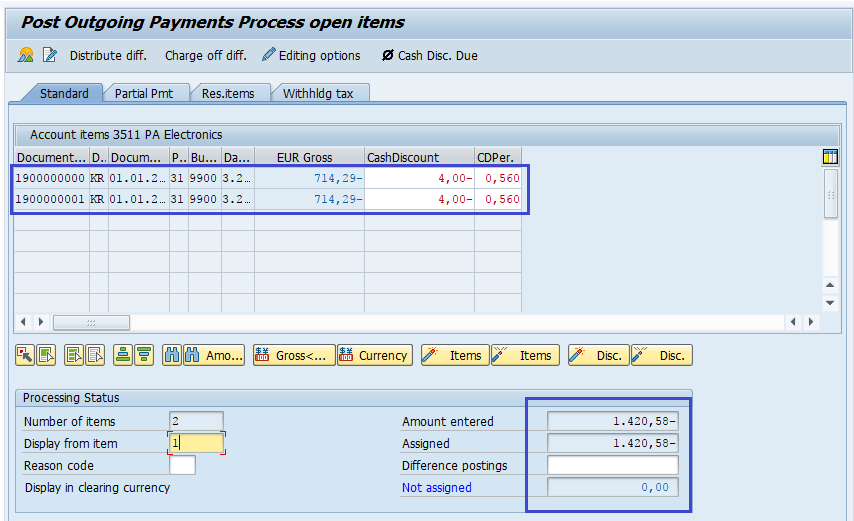

Step-4: In the next screen, Assign the Payment Amount to Appropriate Invoice in the Standard tab.

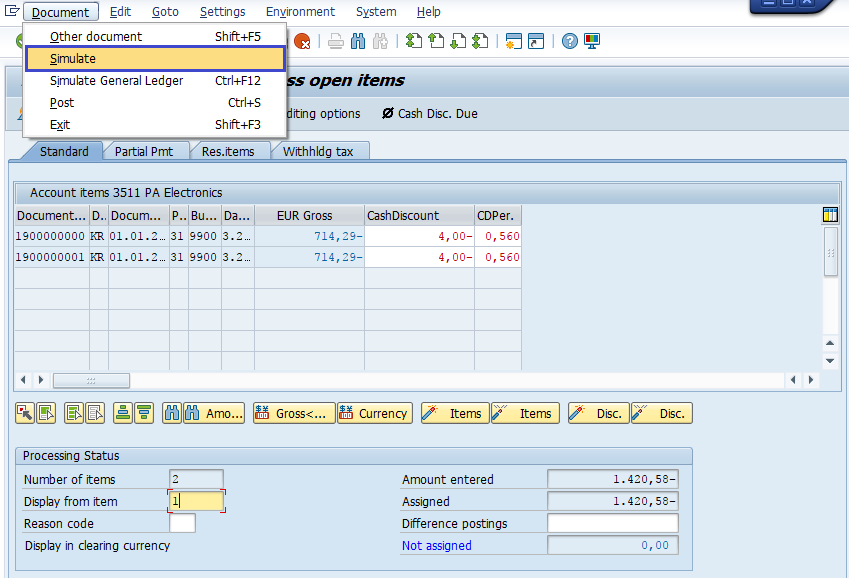

Step-5: From the Standard Menu bar, click on Document Simulatefor Clearing Document.

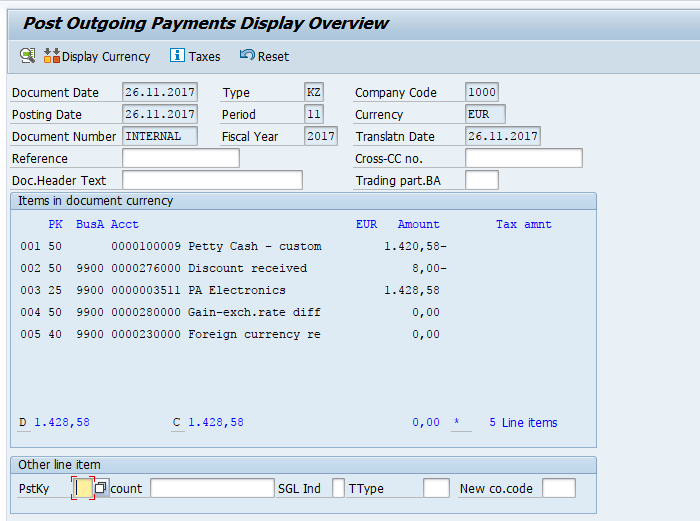

Step-6: In the next screen, check the Withholding Tax credited as per the base amount entered in the Invoice.

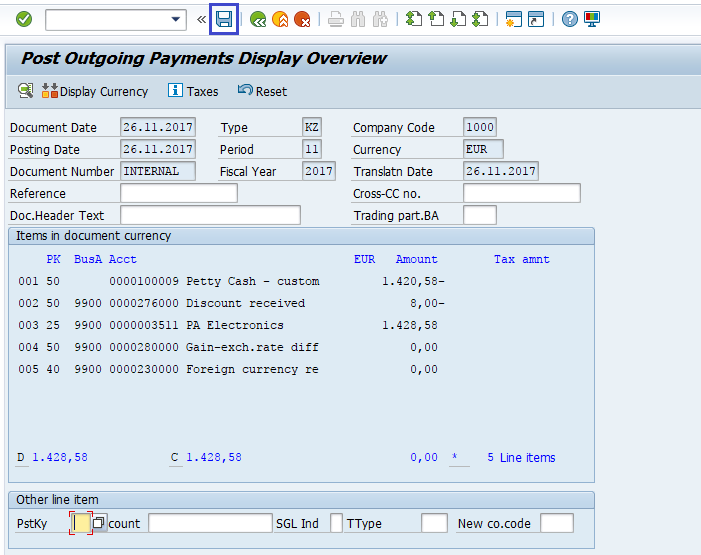

Step-7: Once all the details entered, click on the Save button to save the changes.

Status bar displays the generated document number once the vendor invoice posted successfully.

Technical Information: -

- Transaction Code: - F-53

- Navigation path: - SAP Menu → Accounting → Financial Accounting → Account Payable → Document Entry → Outgoing Payment → Post