SAP CCA Accrual Calculation

Operating expenses are frequently allocated differently in financial accounting compared to the cost accounting. With the help of the accrual calculation functions, these costs can be considered into account in the Controlling component.

The accrual accounting is important to produce accurate financial statements. You distribute irregularly-occurring expenses, according to cost-origin, on the months in which they are incurred.

The irregularities within cost accounting can be avoided with the help of above. Costs allocated in this method are called as accrued costs. Accrual calculation can be done in two ways −

- Accruals in the Financial Accounting component (FI) using recurring entries.

- Accruals in the Controlling component based on the costs posted with the below approaches.

- Accrual calculations using the percentage method

- Accrual calculations using the target=actual method

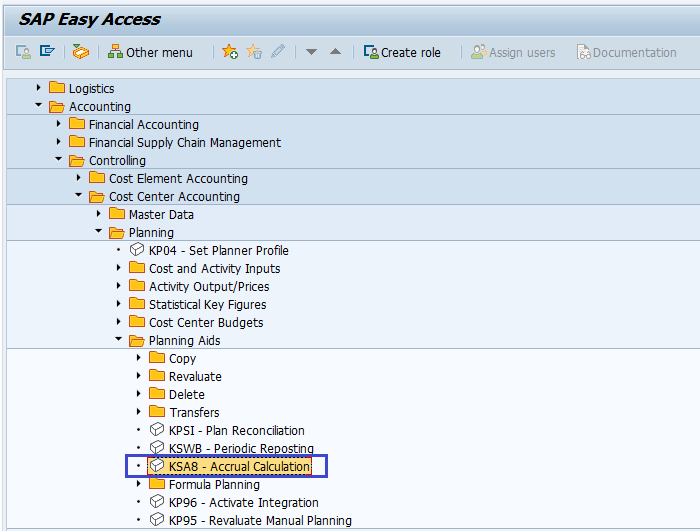

The process to perform the accrual calculation from the Cost Center Accounting menu below −

Step-1: − Go to Accounting → Controlling → Cost Center Accounting → Planning → Planning Aids → Accrual calculation.

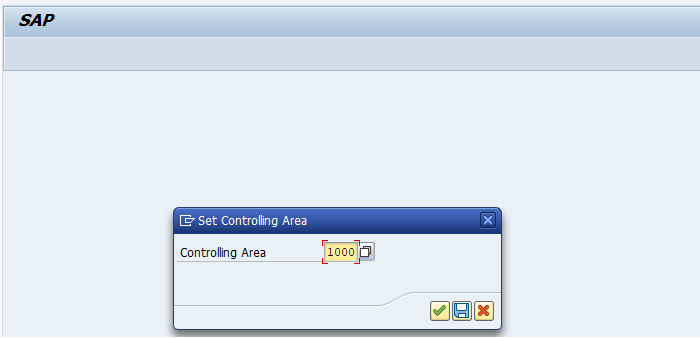

Step-2: − Enter the Controlling Area and click on tick mark to proceed.

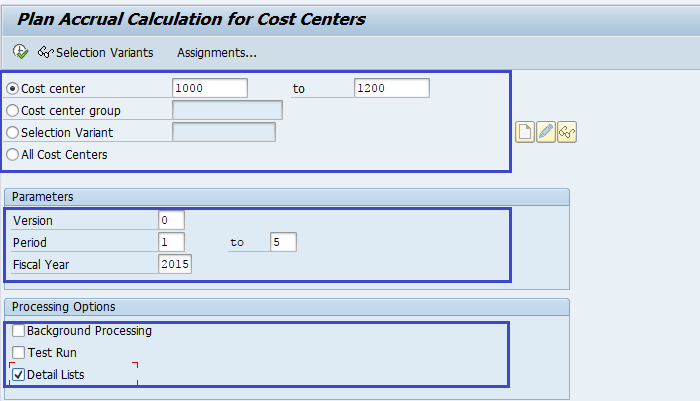

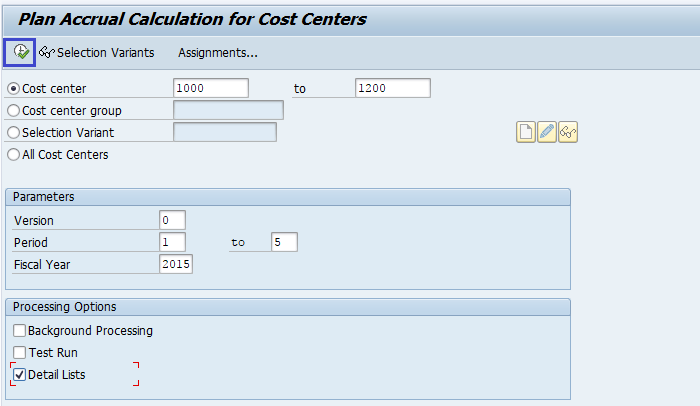

Step-3: − In the next screen, enter the Version, fiscal year and the posting period.

Check/Uncheck the processing options based on the requirement.

If the background processing option not selected, accrual calculation are processed online and displays the values calculated for the accrual cost elements.

Step-4: − Click on Execute to display the results.

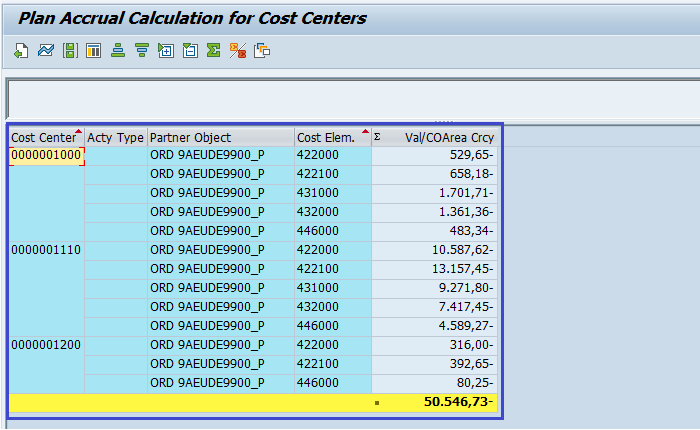

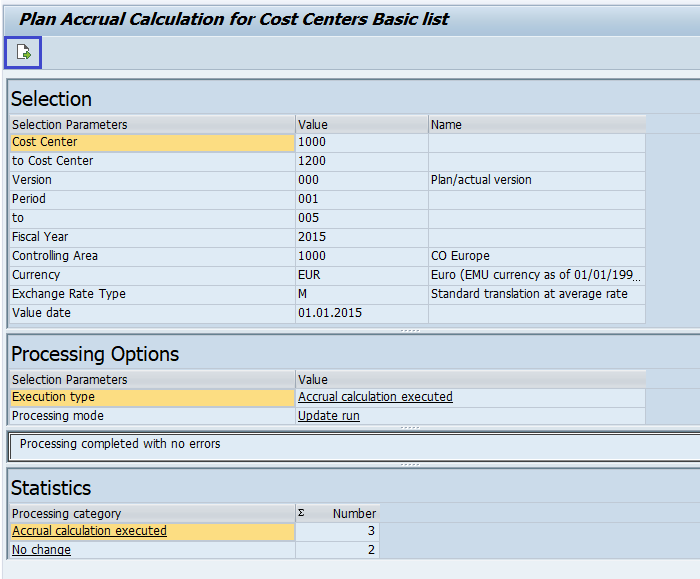

The below results will appear.

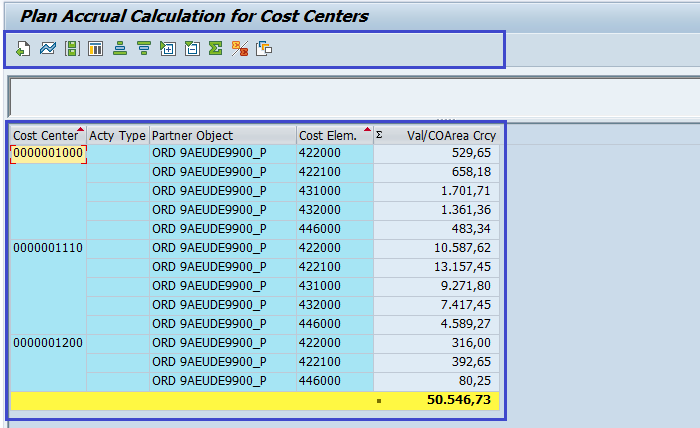

Step-5: − Click on the Arrow mark to perform the calculations.

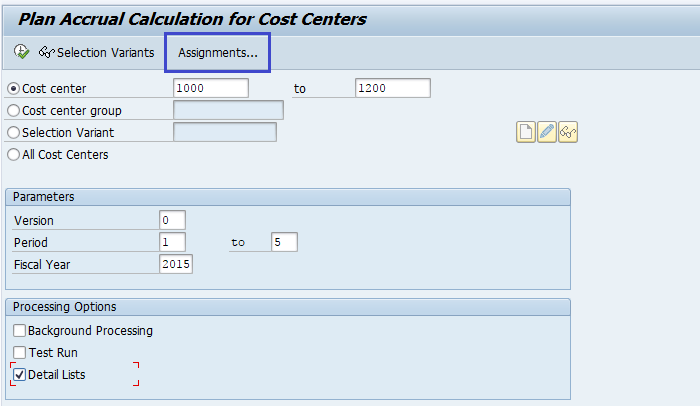

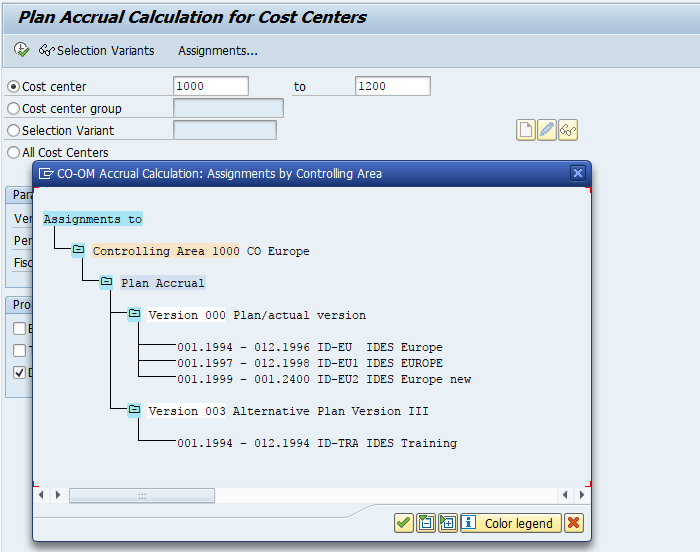

Step-6: − To display controlling area, overhead structure assignments, go to the screen shown in step-3 and click on Assignments.

Step-7: − The below screen will appear.

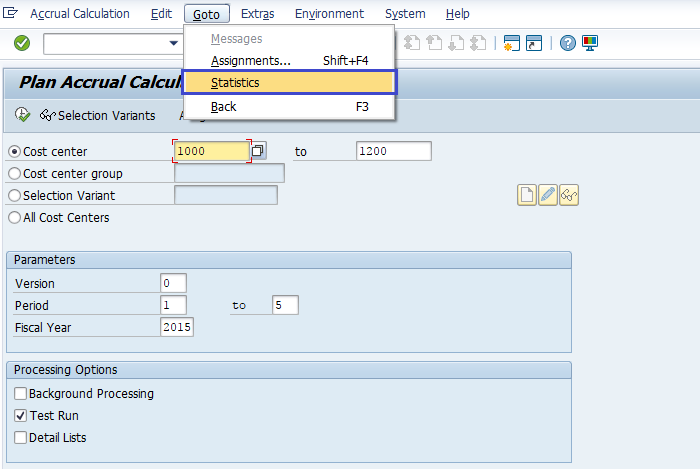

Step-8: − Click on Go to → Statistics to check the errors when the accrual calculation completed.

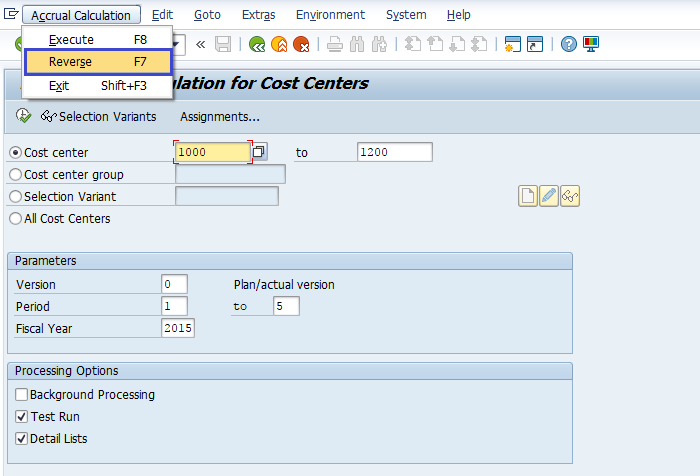

User can perform the reversal of accrual calculation. To perform the reversal, target = actual credit postings and the accrual overhead rates needs to be reset.

Accrual reversal can perform for −

- Cost Center

- Cost Center Group

- All Cost Centers

- Fiscal year Period

Step-9: − To perform reversal, Click on Accrual Calculation → Reverse on the below screen.

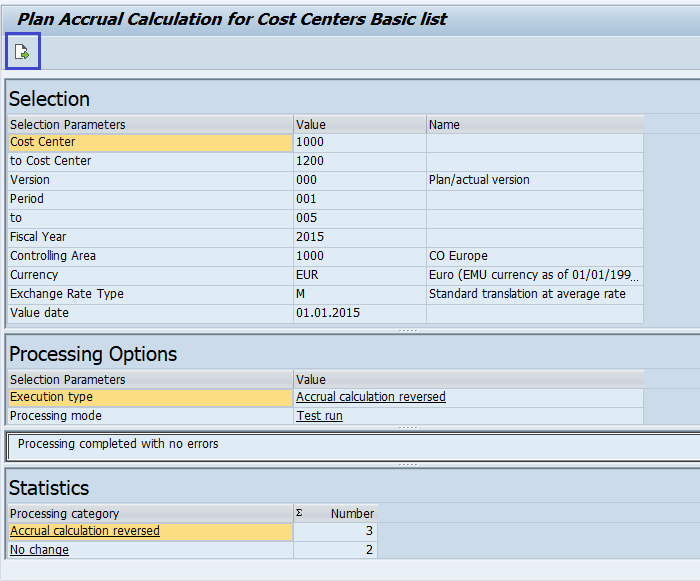

Step-10: − Click on the Arrow mark on the top, to display accrual reversal.

The value is displayed with a –ve sign at the bottom shown in the below screenshot.