SAP FI Credit Memo for Sales Returns

The Sales Returns component is used in the consumer products industry. The Sales Returns component to manage full products that the customer has returned due to a complaint.

The complaints are all related to quality defects but not about deliveries. The returned merchandise path takes often must be tracked in detail.

The Sales Returns component gives an overview of physical warehouse stocks and the corresponding postings whenever require.

Example: -

Once the analysis of the returned merchandise is complete, the vendor or manufacturer determines -- The status of the merchandise and whether it can be reused

- Whether the customer will be credited for the merchandise and the amount of credit

Post a Credit memo for Sales Return: -

Below process is to post a credit memo for sales return.

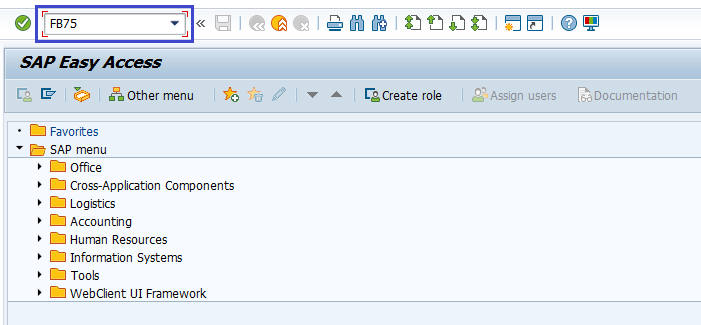

Step-1: Enter the transaction code FB75 in the SAP command field and click Enter to continue.

(OR)

From SAP easy access menu, go to Accounting → Finance Accounting → Accounts Receivable → Document Entry → FB75 – Credit Memo .

Step-2: Enter the Company Code and click on tick mark.

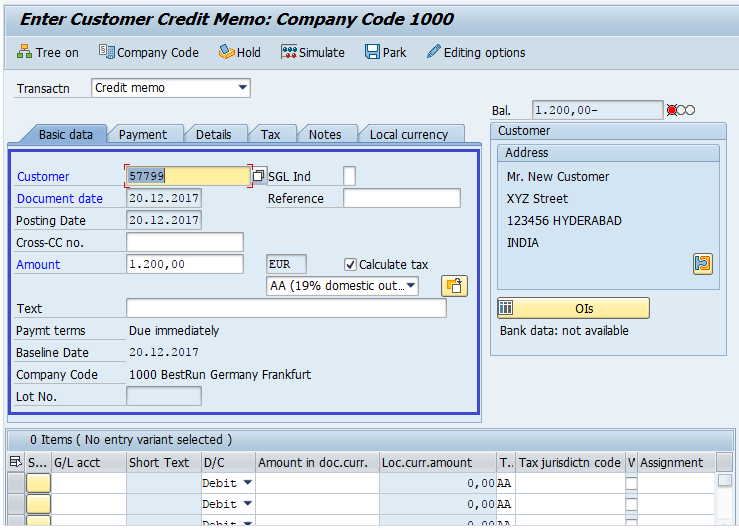

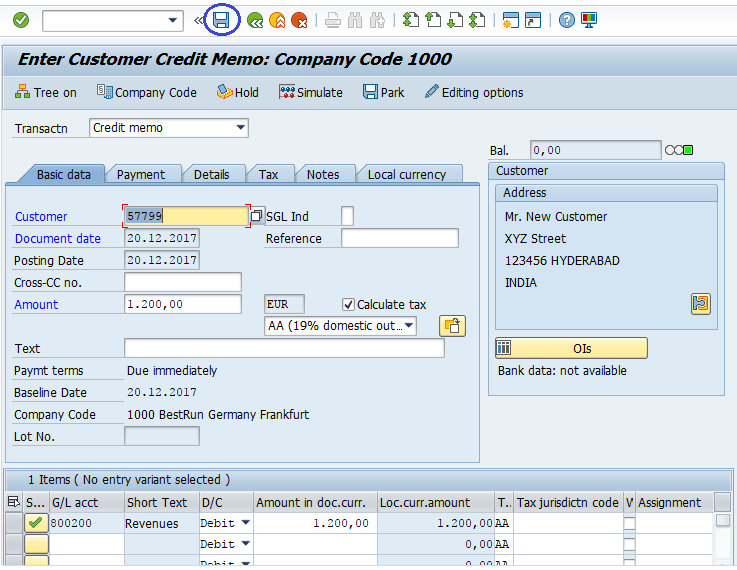

Step-3: In the next screen, enter the below details.

- Customer ID of the customer to be issued the credit memo

- Document Date

- Amount to be credited

- Tax code used in the original invoice

- Check the Calculate Tax check box

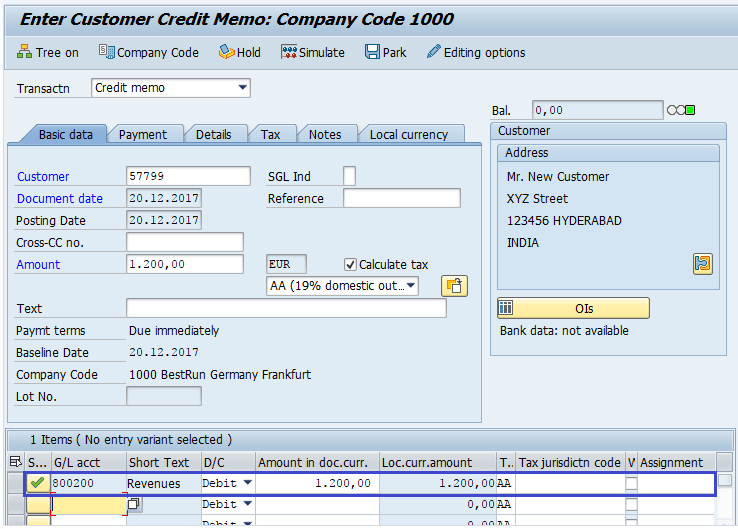

Step-4: In the item details section, enter the below details.

- Sales Revenue Account for the Original Invoice was posted

- Amount to be debited

- Check the Tax code

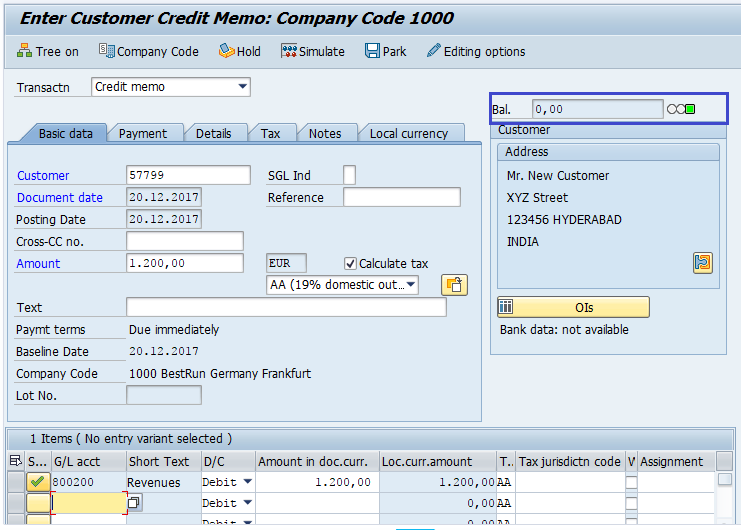

Step-5: Check the status of the document.

Step-6: Click on the Saveicon from the Standard toolbar.

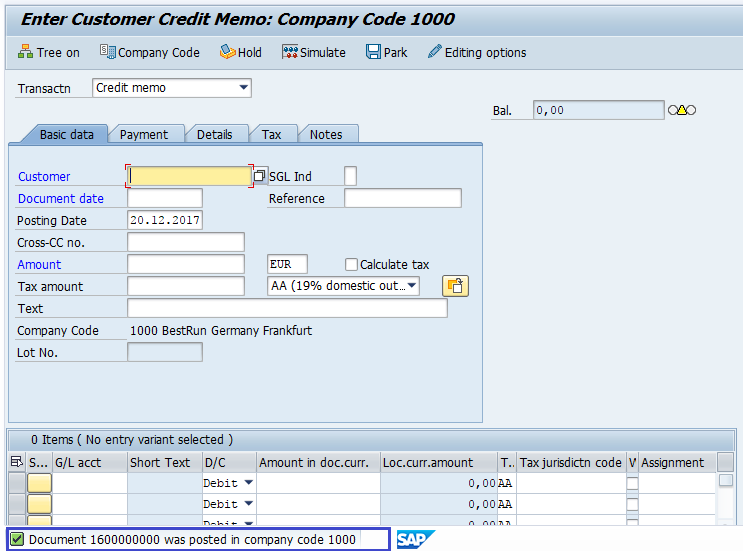

Step-7: Status bar displays the generated document number like below once the sales returns posted successfully.

Technical Information: -

- Transaction Code: - FB75

- Navigation path: - SAP Menu → Accounting → Finance Accounting → Accounts Receivable → Document Entry → FB75 – Credit Memo