SAP FI Post Sales Invoice

Posting accounting data for customers in Accounts Receivable. When posting data in Accounts Receivable, the system creates a document and passes the data entered to the general ledger. General ledger accounts are then updated according to the transaction.

Process: -

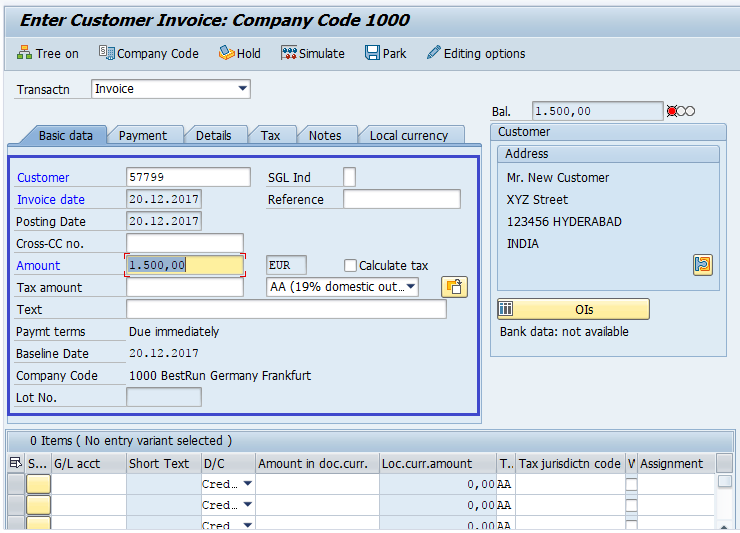

Below process is to post a sales invoice for the customer 57799.

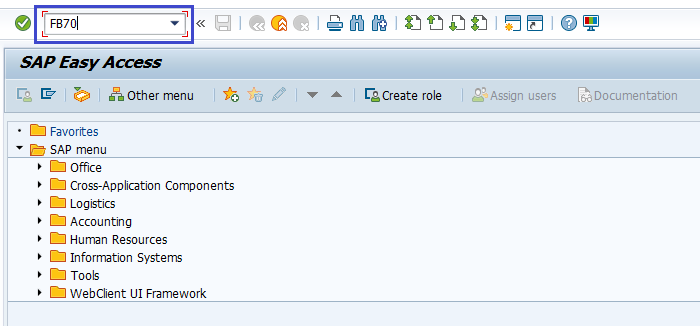

Step-1: Enter the transaction code FB70 in the SAP command field and click Enter to continue.

(OR)

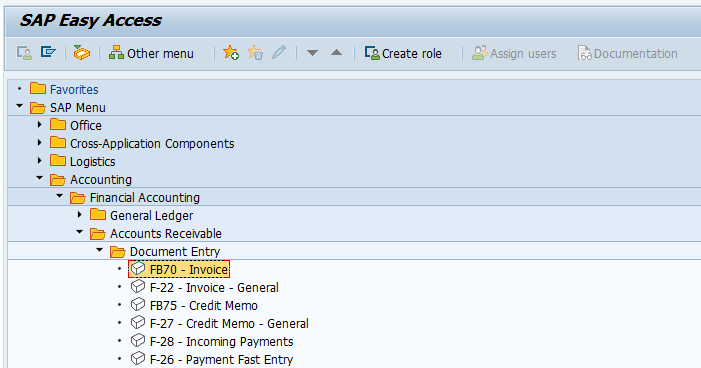

From SAP easy access menu, go to Accounting → Finance Accounting → Accounts Receivable → Document Entry → FB70 – Invoice .

Step-2: In the next screen, enter company code and click on tick mark.

Step-3: In the next screen, enter the below details in the Basic Data tab.

- Customer ID of the customer to be Invoiced

- Invoice Date

- Amount for Invoice

- Tax Code for the Tax Applicable

- Tax Indicator Calculate Tax

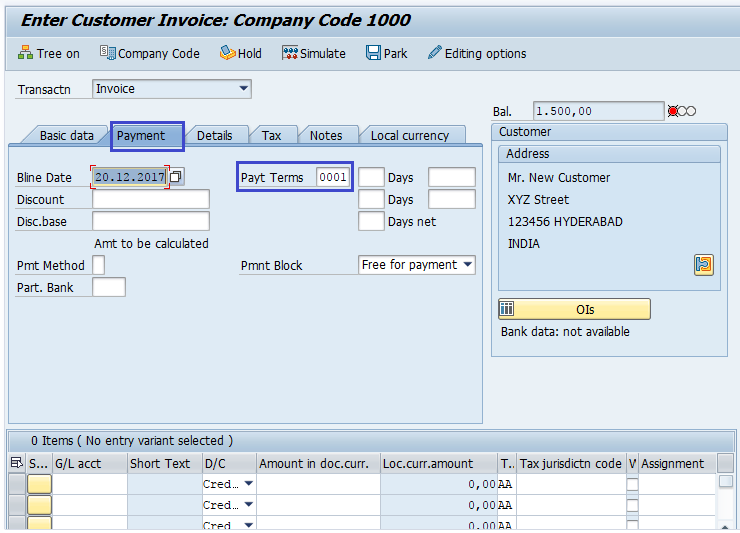

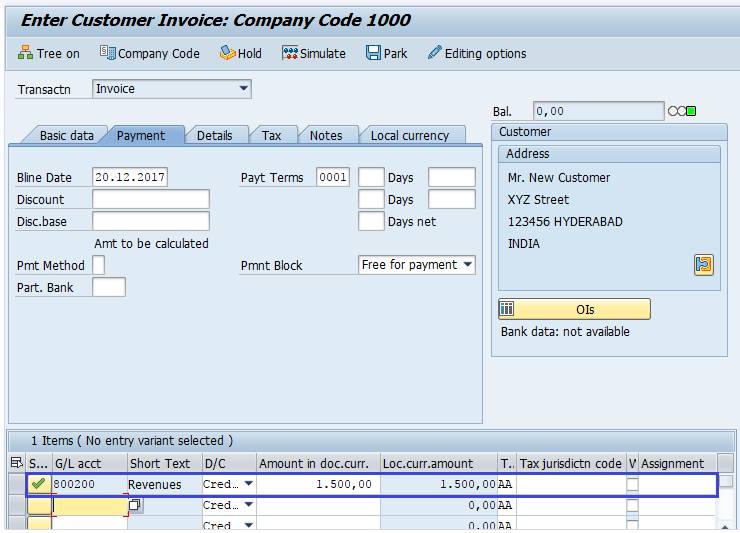

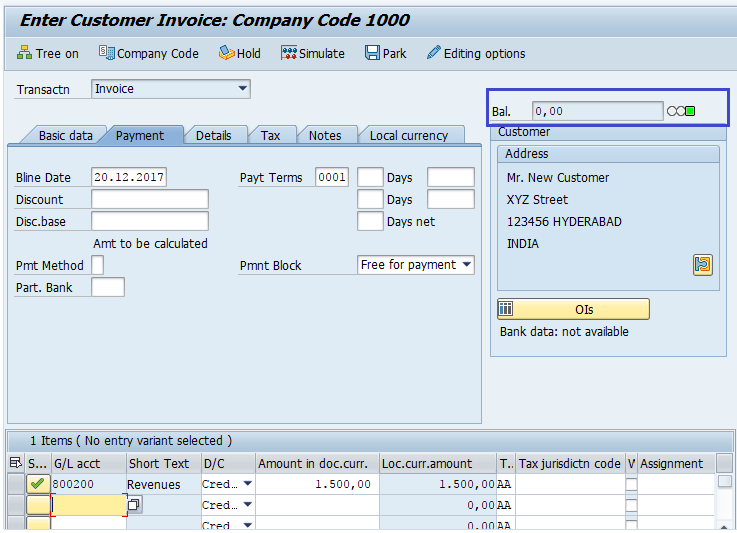

Step-4: Check for payment terms in payment tab.

Step-5: In the Item Details Section, enter the below details.

- Sales Revenue Account

- Credit

- Amount for the Invoice

- Check Tax code

Step-6: After completing the above entries check the status of the document.

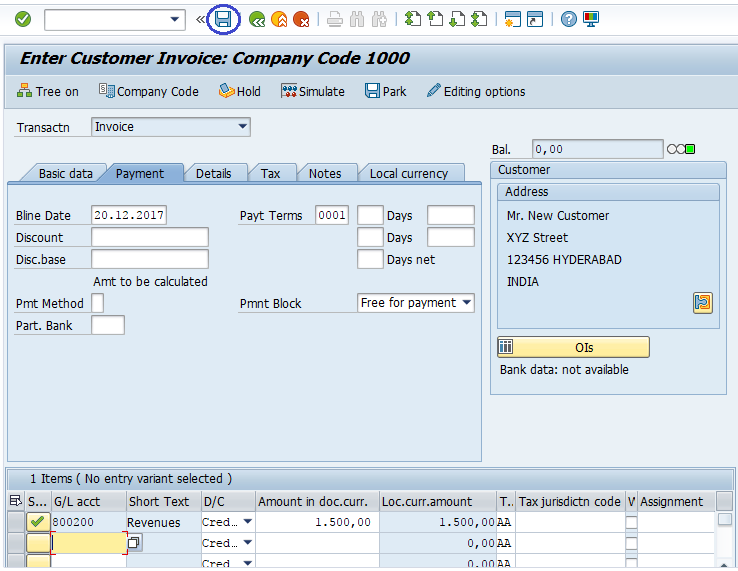

Step-7: Once all the details entered, click on the Save button to save the changes.

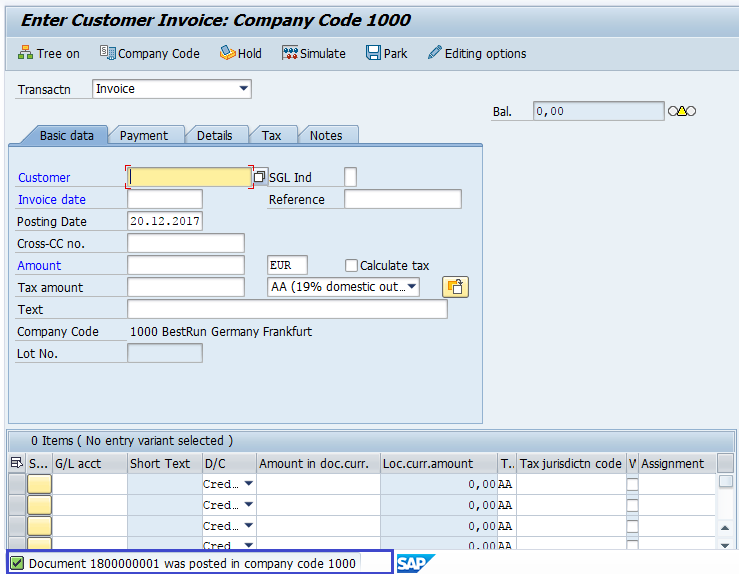

Step-8: Status bar displays the generated document number like below once the sales invoice posted successfully.

Technical Information: -

- Transaction Code: - FB70

- Navigation path: - From SAP easy access menu, go to Accounting → Finance Accounting → Accounts Receivable → Document Entry → FB70 – Invoice .