SAP FICO Document Reversal

Incorrect document entry can be reversed and can also clear the open items. A document can only be reversed if -

- It contains no cleared items.

- It contains only customer, vendor and G/L account items.

- It was posted with Financial Accounting.

- All entered values such as business area, cost center and tax code are still valid.

Reverse a Document: -

Below process is to reverse the already posted document 100000004.

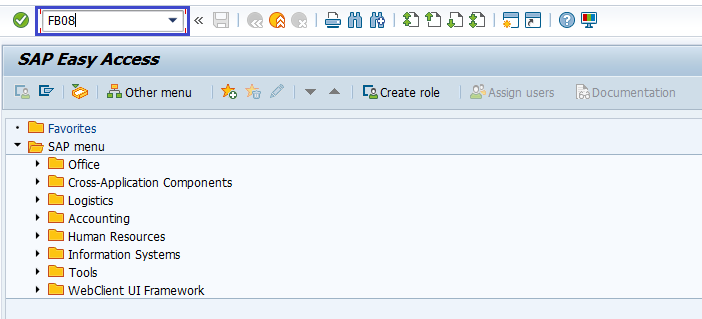

Step-1: Click on SAP Menu → Accounting → Financial Accounting → General Ledger → Document → Reverse → FB08 – Individual Reversal.

(OR)

Enter the transaction code FB08 in the SAP command field and click Enter to continue.

Step-2: In the next screen, enter the below details.

- Document number of the Document to be reversed.

- Company code of the Document posting.

- Fiscal Year for the Posting.

- Reversal Code (Reason for Reversal).

- Posting date Or Posting period.

Tip! If document has allotted a check for payment, enter the reason code to void the check.

Step-3: Check the document by pressing Display before reversal.

Step-4: Check the document.

Step-5: Move back to previous screen and then press Save from the Standard toolbar.

Step-6: Check the status bar for the generated reversal document number.

Technical Information: -

- Transaction Code: - FB08

- Navigation path: - SAP Menu → Accounting → Financial Accounting → General Ledger → Document → Reverse → FB08 – Individual Reversal